dependent care fsa income limit

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. For 2022 the IRS caps employee contributions to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately.

What Is A Dependent Care Fsa Wex Inc

As an annual account.

. Their income was more than 4300. Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. Since FSA contributions are pre-tax you save money by not paying taxes on your contributions. ARPA automatically sunsets the increased dependent care FSA limit at the.

Ad Custom benefits solutions for your business needs. Dependent Care Flexible Spending Account Contribution Limits. 3600 if your 2021 earnings were 130000 or more.

Back to main content Back to main content. From General To Limited Purpose FSAs We Have The Right Plan For Your Healthcare Needs. Ad Our Healthcare FSA Provides Significant Savings To Both Employees Employers.

The minimum and maximum amounts you can contribute to the Dependent Care FSA are set by your employer although the maximum allowed by the IRS is 5000 a year. A dependent qualifies if they were either. Under IRS rules governing Dependent Care FSAs the annual maximum you may contribute is 5000 or 2500 if you are married and filing a separate tax return.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. The guidance also illustrates the interaction of this standard with the one-year increase in the. If your tax filing status is Married.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income. The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for single taxpayers and married couples filing jointly and to 5250 up from 2500 for married. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

Ad Professional Benefits Services. Dependent Care FSA Contribution Limits for 2022. Maximum Annual Dependent Care FSA Contribution Limits.

Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The IRS sets dependent care FSA contribution limits for each year.

5000 if your 2021 earnings were less than 130000. Easy implementation and comprehensive employee education available 247. Eligible dependents must be under age 13 or physically or mentally incapable of caring for.

If your tax filing status is Single your annual limit is. You or your spouseRDP if filing a joint return could be claimed as a dependent on someone elses tax return. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately.

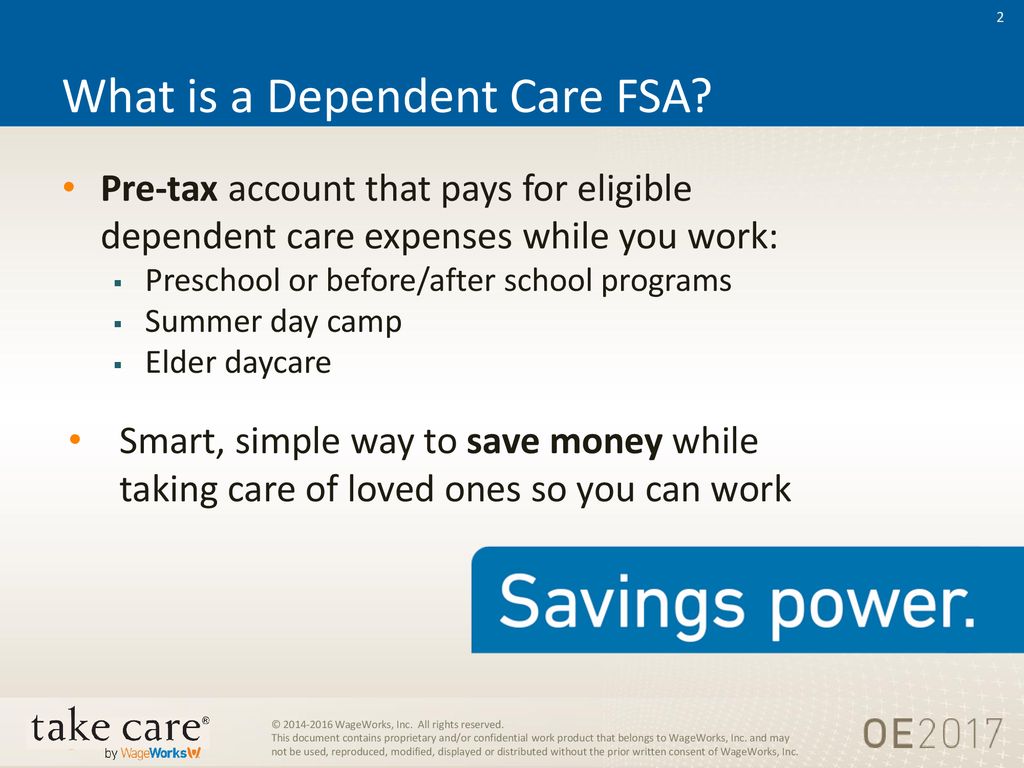

What is a Dependent Care FSA. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. There are some qualifications to be eligible to take advantage of the full amount.

Note that the third item also permits individuals to qualify if they would have been a tax dependent but for the fact that they received gross income in excess of the dependency limit 4300 indexed for that year filed a joint return or the employee or spouse could be claimed as a dependent on someone elses tax return. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. However your contributions may not be in excess of your earned income for the plan year.

Elevate your health benefits. A Dependent Care FSA DCFSA. The maximum amount you can contribute to the Dependent Care FSA depends on your marital status.

Dependent care FSA increase to 10500 annual limit for 2021. Would have been your dependent except. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary IRS annual contribution limit for 2022. Mentally or physically incapable of taking care of themselves. This was part of the American Rescue Plan.

3 rows Dependent Care FSAs DC-FSAs also called Dependent Care Assistance Plans DCAPs 2022. Get a free demo. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021.

They filed a joint tax return. ARPA Dependent Care FSA Increase Overview. Employers can choose whether to adopt the increase or not.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. Dependent Care FSA Increase Guidance. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care expenses to enable you to work.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsa Flexible Spending Account Ppt Download

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Why You Should Consider A Dependent Care Fsa

Dependent Care Flexible Spending Accounts Flex Made Easy

What Is Fsa Dependent Care Workest

Child Care Tax Savings 2021 Curious And Calculated

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Child And Dependent Care Expenses Credit Youtube

Are Virtual Day Camps And Daycare Eligible Under A Dependent Care Fsa Vita Companies

What You Need To Know Before Getting A Dependent Care Fsa Account

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

You Can Get Up To 8 000 In Child And Dependent Care Credit For 2021 Forbes Advisor

:focal(899x643:901x645)/dependent-care-fsa-guide-2000-795d22577ea44cb5aecf2e9faccd410a.jpg)